Read time 4 minutes

When the World Looks Away, Value Hides

When the World looks away, Value hides….Value is often found where no one wants to look.

In markets, it’s the ignored sectors. In medicine, it’s rare diseases, conditions that affect so few people that systems quietly move past them.

I know this because I became one of those people.

In a small clinic in India, I waited, not for treatment, but for a name. Years passed while specialists searched textbooks, second-guessed symptoms, and admitted uncertainty. My illness was so rare that even experts struggled to identify it.

That waiting room taught me something markets never had: Scarcity changes you, Uncertainty shapes you and Survival forces innovation.

When My Life Turned Without Warning

In 2015, I thought I was pressing pause.

I had stepped away from the relentless rhythm of work, markets, deals, constant motion. I believed I understood volatility. I had built a career around it.

Then my body collapsed the illusion of control.

The diagnosis came slowly. First disbelief. Then confusion. Then fear.

Isaacs’ Syndrome. It is a rare neurological condition where muscles refuse to rest, twitching as though they’ve forgotten silence.

Can you imagine your body becoming a restless stock ticker, never pausing, never closing?

Before I could even grasp that, another diagnosis followed: Lyme disease. A master of disguise, it hides in tissues, evades detection, and mimics other illnesses for years. A phantom market crash I never saw coming.

Then came Glaucoma, threatening my vision. Then Membranous Glomerulonephritis, an autoimmune kidney condition. Irritable Bowel Syndrome (IBS), Diabetes, Frozen Shoulder, Eczema and Blood Pressure issues.

My body began to resemble the most volatile market I had ever seen.

And I was no longer just the investor.

I had become the asset under stress.

From Trading Floor to Hospital Bed

In finance, I was comfortable with complexity.

In rare disease, complexity was ruthless.

- There was no clear data.

- No reliable timelines.

- No standard playbook.

Doctors disagreed. Tests contradicted each other. Treatments worked, until they didn’t.

Yet somewhere between hospital beds and waiting rooms, something unexpected happened……

I realised my financial training hadn’t abandoned me.

It had followed me here and I began to:

- Track symptoms like market trends

- Weigh treatments like risk exposure

- Allocate money across care, insurance, nutrition, and therapy

- Diversify approaches instead of betting on a single solution

I learned to make decisions with incomplete information. To survive volatility without panicking. To think long-term when short-term outcomes looked bleak.

Slowly, patterns emerged.

The mindset that builds financial resilience also builds personal resilience.

The Hidden Alpha of Rare Diseases

In finance, alpha is the edge, the return beyond the market average. The thing everyone searches for but few find.

My health journey revealed another kind of alpha.

Rare diseases live in:

- Overlooked data

- Unusual methods

- And people forced to become experts in their own survival

1. Trial Before Certainty

There were no guaranteed treatments. Every intervention was a calculated risk. Some failed. Some helped. Each taught me something. Progress came through courage, not certainty.

2. Patients as Pioneers

When systems stalled, patients and families pushed forward. Questions were asked. Assumptions challenged. Discoveries often began outside formal structures.

3. Technology as Leverage

AI, genomics, registries, these tools surfaced signals doctors couldn’t see before. What felt experimental for rare patients is now shaping mainstream medicine.

4. Small Numbers, Big Breakthroughs

Gene therapy. Precision medicine. CRISPR. Many of today’s biggest medical advances were born in tiny patient populations.

Rare diseases are not the margins of medicine.

They are its testing ground.

Why This Matters to Investors

This is where my two worlds meet. Investors often chase safety. Scale. Familiar names.

But real disruption rarely comes from the centre.

It comes from the edges.

- Rare-disease biotech looks risky, until one discovery changes an entire category

- Complex, tiny datasets force breakthroughs in analytics that ripple outward

- Tools built for rare patients, genetic testing, telemedicine, AI diagnostics, are now redefining healthcare

- The next wave of value creation may not rise from giants, but from what we once ignored.

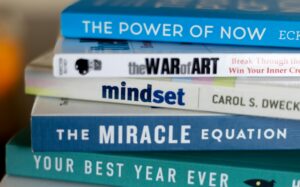

The Comeback Mindset I Learned as a Patient

Recovery, for me, wasn’t about returning to a job. It was about reclaiming agency.

Illness taught me the same traits that define great investors:

- Adaptability when conditions change

- Patience through long uncertainty

- Discipline without guaranteed rewards

- Resilience when progress feels invisible

- Long-term vision when short-term outcomes disappoint

Ironically, the skills that built my career were forged even sharper by illness.

What I’d Tell Fellow Patients

If you’re navigating your own storm:

- See yourself as an asset, your resilience has value

- Your journey gives you insights others don’t have

- Invest in health first, everything else depends on it

- Stay curious, knowledge is leverage

- Think long-term as healing is rarely linear

How I’m Trying to Shape What Comes Next

Today, I try to contribute in practical ways:

- Registering in health programs

- Tracking my health daily

- Sharing anonymised genetic data

- Supporting connected health records

- Engaging with multidisciplinary experts

Each step strengthens the data ecosystem that future patients will rely on.

This is not charity…. It’s infrastructure.

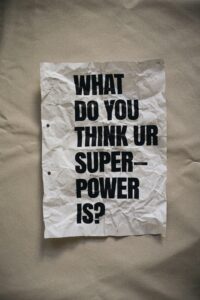

A Final Thought

Living with Isaacs’ Syndrome, Lyme disease, glaucoma, kidney disease and more, taught me this:

What looks scattered often holds the greatest potential.

For me, the hidden alpha wasn’t just in rare disease research or investment logic.

It was rediscovering my ability to adapt, learn, and lead.

I am healthier now. More aware. And ready again.

Rare diseases don’t just reshape medicine. They reshape people.

And if we’re willing to look where others don’t, they may reshape the future of healthcare, of investment, and of how we define value itself.

DISCLAIMER

The views expressed in this article are the author’s own and do not represent any medical advice.